Difference between PPP and ERC

ERC is Not a loan

ERC does NOT have to be paid back

ERC is NOT taxed

ERC does not have to be used for business expenses, owner can use it for whatever they want

ERC Can be used to pay off any amount of PPP Loan if still outstanding

PPP was originally a loan

PPP was to be paid back but many loans were forgiven

PPP was earmarked for business expenses only

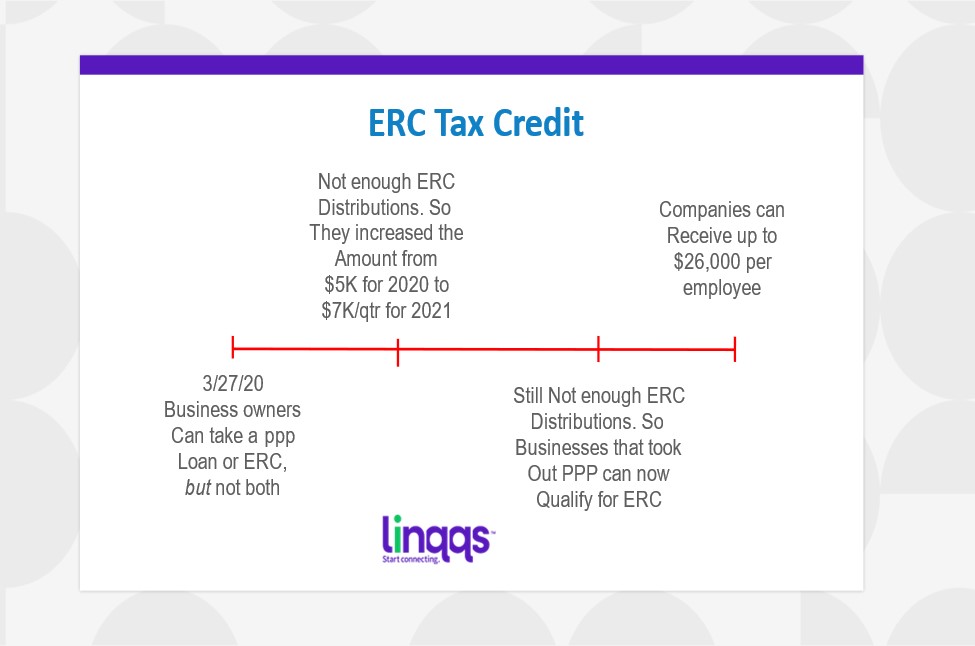

Did your business take advantage of the ERC Tax Credit Program! DON’T MISS OUT

ERC: Employee Retention Tax Credit

Who Qualifies:

– Most Small Businesses w/ FT-W2 Employees (30 hr/wk or 130hr/mn)

– Businesses that show a significant decrease in revenue during the pandemic OR

– Businesses with parital or complete shut downs OR

– Businesses who’s practices were affected by the pandemic (supply chain, processes, etc)

The only way to know if your business qualifies & for how much, is to follow this simple process (takes 10 mins with NO upfront fee)

- Go to your ERC Consultants website together

- Fill out the questionnaire and get an estimate amount

- Upload Docs to a secure Portal

- 5-10 days later, final approval w exact amount is generated

- File amended taxes, 4-6 months funds received

Call today to see if your business qualifies and for how much!

Nancy Krampetz * ERC Certified Specialist * 925-383-8018